Steel Decarbonization Dynamics Service (SDDS)

Insights into the Steel Industry’s carbon conundrum

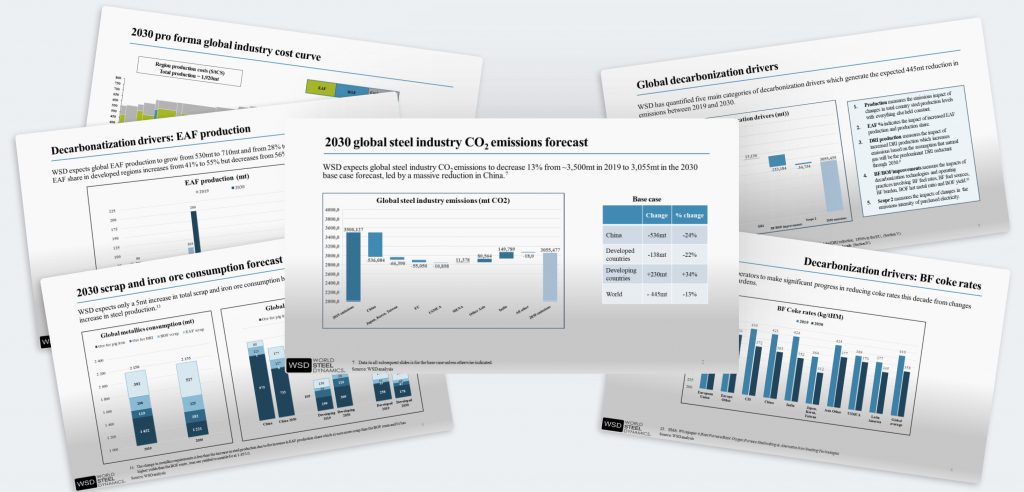

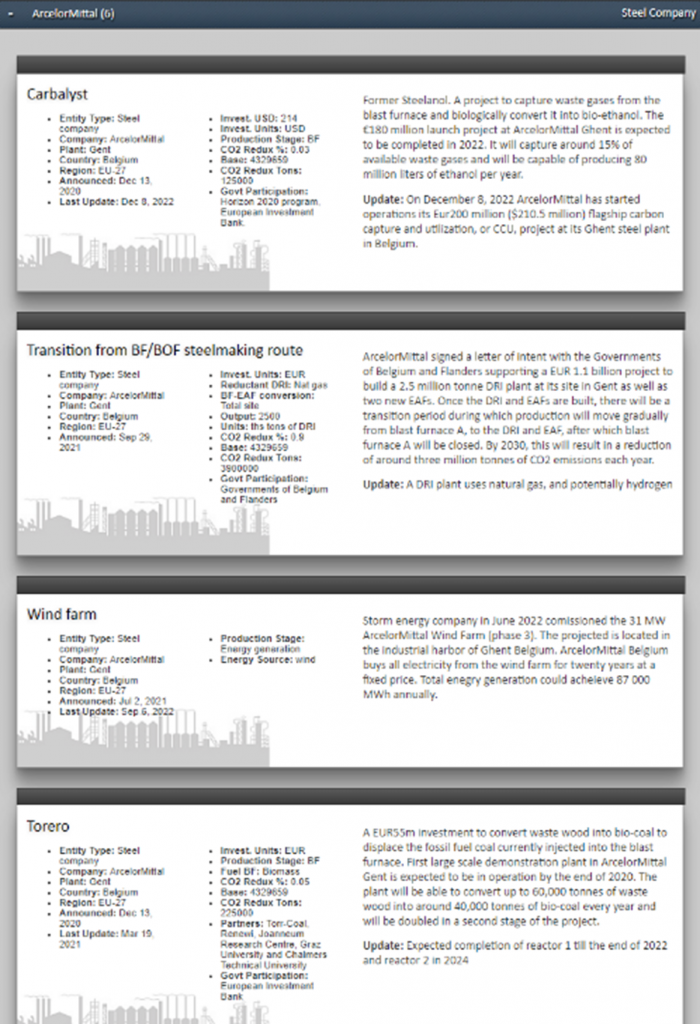

The Steel Decarbonization Dynamics Service (SDDS) is a comprehensive information package focused on the global steel industry’s decarbonization challenge that consists of analyses, forecasts and customizable models with an outlook to 2030, 2040 and beyond. It differs from the ever-increasing number of steel industry decarbonization reports in three key ways:

- Our Reports focus not on what could happen or what needs to happen, but rather on what is likely to happen…and

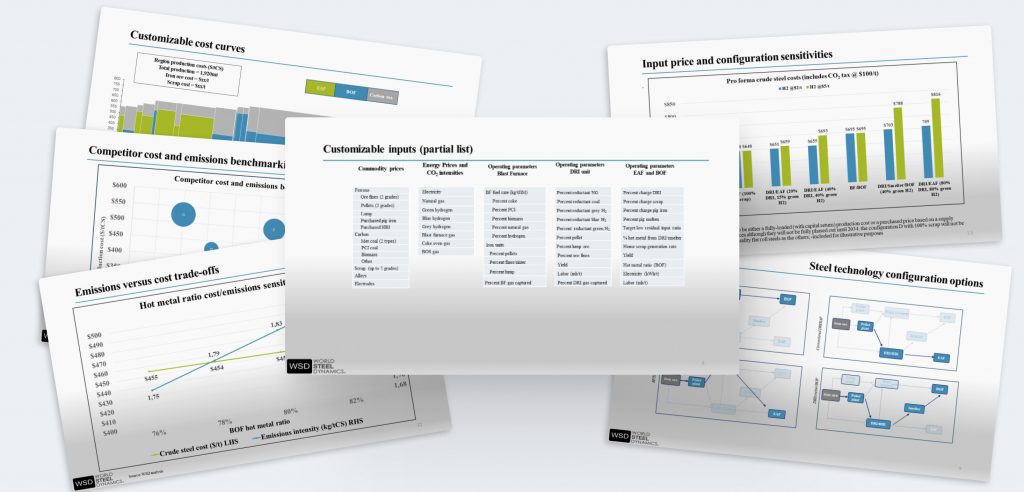

- Our proprietary model provides a holistic assessment of CO2 emissions, cost structures, raw materials balances, and energy requirements

- The Service offers the opportunity for the user to create customized scenarios by manipulating hundreds of inputs (country/region/plant-specific)

SDDS continues WSD’s decades-long history of providing rigorous, independent, and often controversial analyses and opinions.

WSD is available for customized presentation, consultation with your Board of Directors, Management Team, etc. Schedule a call today for more information